Stopping the Foreclosure Process: A Guide for Concord, NC Homeowners

When you purchased your home in Concord, the last thing you expected to happen one day was a foreclosure. Losing a job or dealing with health emergencies can quickly result in missed mortgage payments. Getting a notice from the bank about foreclosure is just one more challenge to be faced. Stopping the foreclosure process of your Concord, NC, home can be difficult but not impossible. Communicating with the banks, negotiating terms, and stressing over your mortgage can feel unbearable, but you have options.

Foreclosure is more common than you might think and impacts homeowners in Concord, NC, daily. If you need help stopping the foreclosure process in Concord, here are some things to consider for stopping foreclosure.

Give your Lender a Call Right Away

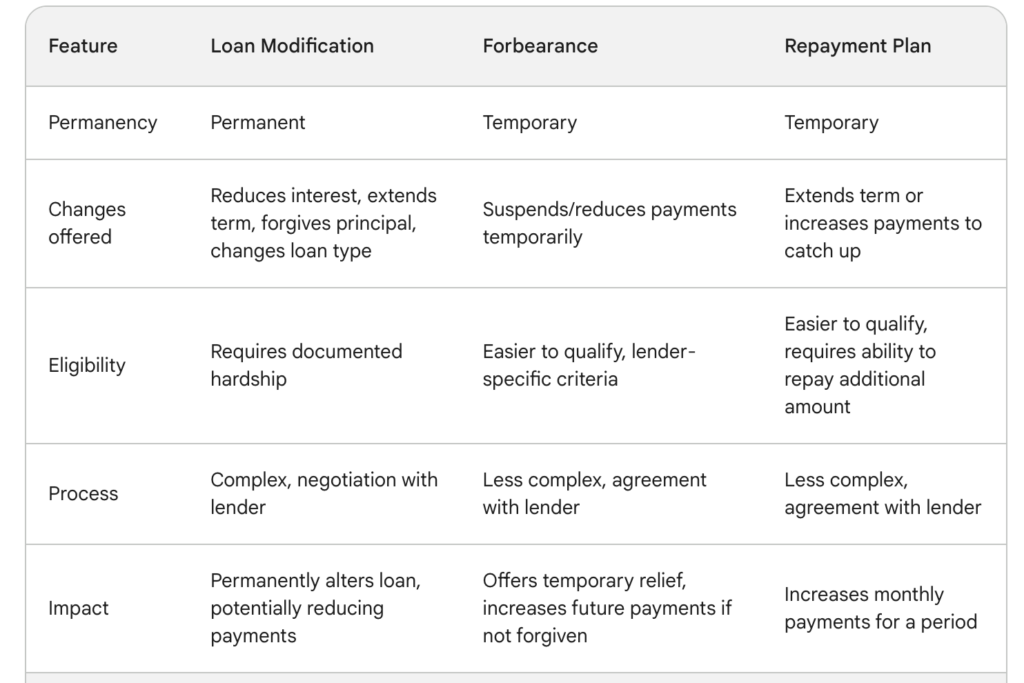

If you miss a payment, contact your bank immediately. Ask for guidance, inform them of your situation, and explain how you plan to get caught up on the loan. Keep records of conversations and missed payments. They may be willing to work with you on a solution such as loan modification, forbearance, or a repayment plan.

Loan Modification: A permanent change to the terms of your existing loan that can reduce interest rate, extend loan term, forgive principal, or change loan type. Requires documented financial hardship and negotiation with the lender. Offers potential savings on monthly payments and can save your home.

Forbearance: A temporary agreement to pause or reduce your loan payments for a set period. Easier to qualify for, but missed payments are usually added to the end of your loan.

Repayment Plan: An agreement to catch up on missed payments over a set period that increases your monthly payments for a period but doesn’t change the overall loan terms. Easier to qualify for but requires you to demonstrate the ability to repay the additional amount.

Explore Government Programs

As a homeowner, if you’re struggling to make your mortgage payments, several government programs are available to help you. These programs include the Home Affordable Modification Program (HAMP) and the Home Affordable Refinance Program (HARP), which can help you reduce your monthly payments, lower your interest rate, or even forgive a portion of your loan balance. The City of Concord, NC, also provides valuable resources for families in hardship. To stop the foreclosure process, you must do your homework and familiarize yourself with these programs through online research. Preparing to ask good questions will save you time and help you make the most of the available resources.

Federal Programs:

- Home Affordable Modification Program (HAMP): This program incentivizes lenders to modify mortgages for eligible homeowners struggling with payments. It can reduce interest rates, extend loan terms, or forgive a portion of the principal balance.

- Home Affordable Refinance Program (HARP): This program allows homeowners to refinance their mortgages even if they owe more than their home is worth, potentially lowering their monthly payments.

- Federal Housing Administration (FHA): FHA offers various programs for homeowners facing foreclosure, including loan modifications, forbearance, and refinancing options.

North Carolina Programs:

- NC Homeowner Assistance Fund (NCHAF): This program provides financial assistance to eligible homeowners to prevent mortgage delinquency, default, and displacement due to COVID-19. It can cover past-due mortgage payments, property taxes, homeowners insurance, and other housing-related costs.

- NC Foreclosure Prevention Fund: This program offers financial assistance to eligible homeowners facing foreclosure due to a temporary financial hardship. It can cover mortgage reinstatement, missed payments, and other housing-related costs.

- NC Housing Finance Agency (NCHFA): NCHFA offers various resources and programs for homeowners facing foreclosure, including free foreclosure prevention counseling, legal assistance, and information on other available resources.

Additional Resources:

- Concord, NC Community Development Department: This department offers resources and programs to assist residents facing housing challenges, including foreclosure prevention.

- HUD-approved housing counseling agencies: These agencies provide free or low-cost counseling to homeowners struggling with mortgage payments and facing foreclosure. You can find a HUD-approved counselor in your area by visiting the HUD website: https://www.hud.gov/program_offices/housing/sfh/hcc/housing_counseling

Seek Legal Assistance

Consult a foreclosure defense attorney in Concord, NC, for guidance. They can help you understand your options, negotiate with your bank, and represent you in court if necessary.

Is a Short Sale an Option?

If you cannot make your mortgage payments and do not qualify for a loan modification, a short sale may be an option. This is when you sell your house for less than you owe. While this will still result in the loss of your home, it can be less damaging to your credit score than what occurs with a foreclosure.

Keep Moving Forward and Stay Organized

Staying organized and keeping track of all phone calls and emails with your lender and any other parties involved is essential throughout the foreclosure process. Keep copies of your mortgage agreement and payments. This will help you stay on top of the process and ensure you have all the information you need to make informed decisions.

Stay In Your House and Make a Plan

While it may be tempting to abandon your home once you realize you are in foreclosure, staying there as long as possible is generally in your best interest. Staying in your home will give you time to research your options and work with your lender to find a solution.

Accept Financial Counseling for your Future

If you struggle to make your mortgage payments, meet with a financial counselor. They can help you create a budget and prioritize how to pay off debt. If you are serious about keeping your home, you’ll need help. Having a financial counselor coach you on matters of finance and budgeting is very valuable. The goal is to get you back on your feet and have a plan for your finances.

Foreclosure can feel overwhelming, but remember, you have options. This guide equipped you with the knowledge of various strategies, from government programs to legal counsel, to fight for your home. Take action now, explore the resources mentioned, and don’t hesitate to seek professional guidance. Remember, the sooner you address the situation, the more empowered you’ll be to navigate through this challenge and find a solution that secures your Concord, NC, home and brings you peace of mind.

Contact us today if you would like to discuss how JMS Home Buyers LLC solves real estate problems in Charlotte, NC. Call us at 704-707-6016 or email us at jmshomebuyers@gmail.com.